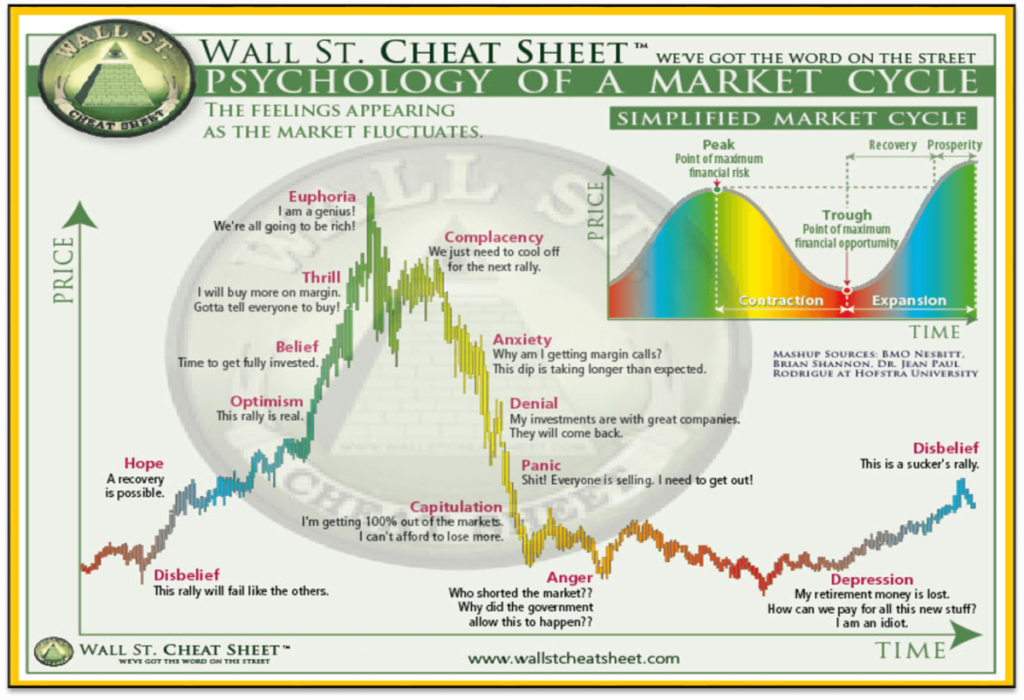

You may have heard more than once that a price chart reflects investor psychology, and the larger the timeframe, the more significant the capital. That’s why our team often emphasizes the importance of following significant capital movements in the market, which becomes impossible without understanding the overall market picture and being aware of the current market cycle.

Below, we will explore each of the psychological market cycles, provide brief characteristics, and recommend the percentage of stablecoins that should be held in the portfolio.

Depression Phase

The depression phase in the market is characterized by low asset prices, low trading volumes, and diminished investor trust. During a depression, investors often shy away from active investments in risky assets. Moreover, widespread skepticism towards the stock market due to negative news at all levels leads to an overall reduction in investment activity.

In this phase, market volatility is minimal. World hunger, wars, and pandemics rage. This is the best time to invest. It is during this phase that significant capital is acquired amid universal gloom. If you employ a gradual asset acquisition strategy, such as the three-order strategy, the third orders are executed in this market phase. It is essential to have an additional percentage for unexpected “discounts” on promising assets. Maintaining a balance of 25-40% in USDT is recommended.

Denial Phase

In this phase, the market slowly begins to recover amid negative news, but Fear, Uncertainty, and Doubt (FUD) have little impact on prices. Significant partnerships, announcements of various developments, and fundamental innovations characterize this market phase, potentially leading to a subsequent bullish market. “Light” assets may reach their first selling targets during this phase. This phase is challenging to recognize due to emotional involvement in the news. Portfolio rebalancing and additional purchases are possible. It is recommended to maintain a balance of 30-40% in USDT, taking into account the closure of initial targets for some assets.

Hope Phase

The hope phase is characterized by the return of “average” capital. Investors begin to look optimistically into the future, leading to increased buying activity, correlated with higher trading volumes and volatility. This can create a self-fulfilling cycle where positive sentiments fuel more significant buying activity, resulting in price growth. The main danger in this phase is the uncertainty of the further trend for most investors, leading to the triggering of high-margin leverages due to volatility. It is recommended to maintain a balance of 40-45% in USDT by closing the first sell orders for most assets.